A. REGULAR SAVINGS DEPOSIT

Product Definition

An interest bearing savings account open to all members of the cooperative.

Product Features

- Saving Deposits can be withdrawn anytime through written or email advice to the Cooperative for record purposes.

- Savings deposit not falling below P1,000.00 during any calendar month shall be entitled to a 2%* p.a. interest.

- Minimum Maintaining Balance for Savings Deposit is P1,000.00.

- Interest is computed daily and compounded quarterly.

- Interest is tax free.

* Effective October 1, 2024.

Terms and Conditions

- Interest rate may change without prior notice.

- Withdrawal of savings deposit can only be done either through check payable to the depositor or credited directly to the depositor’s bank account on record.

B. TIME DEPOSIT

Product Definition

A deposit account with a fixed term of 91.

Terms

Certificate of Time Deposit – A receipt issued by Coop to a depositor who opens a time deposit account. It states the amount deposited, rate of interest and minimum period for which the deposit should be maintained.

Initial Deposit – The minimum amount of money required to open a time deposit account.

Term - The period of time assigned as the lifespan of the time deposit.

Interest rate – A rate which is charged or paid for the use of money.

Maturity – Refers to a finite time period at the end of which the financial instrument will cease to exist and the principal is repaid with interest.

Product Benefits

- Has a higher interest rate compared to normal Savings Deposit accounts.

- Time Deposit interest is tax free.

- Guaranteed earnings for as long as the deposit stays with the coop until the agreed term.

- Higher interest rates vs most banks.

Product Features

| Term | Interest Rate* | Interest Payment |

| 3 Months | 3.0% | Maturity |

| 6 Months | 4.0% | Maturity |

| 12 Months | 5.0% | Maturity |

| 24 Months | 6.0% | Maturity |

*Effective October 1, 2024

Time Deposit Interest Computation: (Amount Invested x Interest Rate) x (Days Invested/364)

Sample Computation

Amount Invested: P100,000.00

Term: 1 year

TD Interest Rate: 5.0%

Interest Earned at maturity (i.e. 364 days): P100,000.00 x 5.0% x (364/364) = P5,000.00

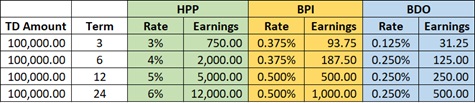

Comparison vs other banks

Note: BPI and BDO interest earnings are subject to 20% withholding tax.

Note: BPI and BDO interest earnings are subject to 20% withholding tax.

Source: BPI and BDO websites as of October 1, 2024.

Terms and Conditions

- The Board of Directors reserves the right to discontinue the Time Deposit products of the Cooperative as well as reject any Time Deposit application without need for explanation.

- Interest rates may change without prior notice.

- Time Deposit proceeds can only be done either through check payable to the depositor or credited directly to the depositor’s BPI Payroll account.

Maturity

- Coop to send an initial notification (15 days before) and final notification (on the day of maturity) that investment is about to mature. Investor will be asked if he/she would like to withdraw or if he/she would like to roll the money for another term.

- The Certificate of Time Deposit will have to be surrendered to the Cooperative on or after maturity date before the deposited amount and the corresponding interest earned can be released.

Pre-Termination

- Investor should notify 15 days before the date of pre-termination.

- 1% interest rate will be applied.

How to Avail

Contact the coop office at This email address is being protected from spambots. You need JavaScript enabled to view it..