Status: On Hold

Reason: Fund allocated to Real Estate Loan has currently been used up. Will be reopened once the Board approves new fund allocation. You may check back later.

Purpose

For purchase/construction/renovation of house & lot, lot only, or condominium unit.

Maximum Loanable Amount

P3,000,000.00 or 90% of the assessed market value of the property/construction, whichever is lower.

Real Estate Fund

The Board of Directors has allocated a certain fund for Real Estate Loans. Once the fund is used up, the Board may decide to increase the fund depending on the current financial condition of the cooperative and the requirements of the membership. Those who cannot be accommodated by the current status of the Real Estate Fund will be placed on the waiting list.

Loan Term

Up to 15 years

Fixed Interest Rate

|

TERM |

1-5 years |

6-10 years |

11-15 years |

|

Interest Rate per annum* |

10% |

11% |

12% |

* Effective interest rate will be lower with Patronage Refund considered.

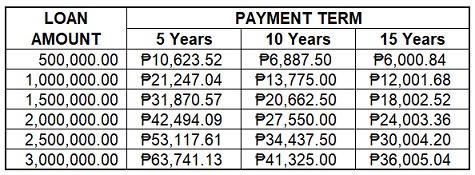

Sample Amortization Schedule:**

**Indicative only and does not include MRI/insurance premiums, Registry of Deeds, and other fees.

Pre-termination/Advance Payment

Members may pre-terminate the loan by paying the remaining balance in full. Advance payments to be applied directly to principal to shorten the payment term is also allowed. No penalties will be charged for pre-termination and advance payments.

Terms and Conditions

- Member should be in good standing (MIGS).

- If married, spouse must also be a member of HPPCOOP (may apply as Dependent here - How to Join).

- Tenure: Member should be at least 2 years with HPPCOOP.

- Share Capital Requirement: At least 5% of loan amount

- All Real Estate Loan will be subject to Board approval.

- Borrower/Member to shoulder processing fees including, but not limited to, appraisal costs, doc stamps, mortgage processing, registration and other fees with the Registry of Deeds, etc.

Approval

Processing time will take 2-4 weeks if requirements are complete. For processing purposes, application forms/documents may be sent via email in advance. Original copies will be required before fund release.

Features

- Minimal Cash Out: Maximum loan amount is up to 90% of assessed market value of the property/construction. Mortgage and other loan-related fees/charges may also be included in the loan amount.

- MRI premiums can be paid in installments, interest-free, and be billed together with monthly amortization. MRI will automatically renew annually for the entire term of the loan.

- Eligible for Patronage Refund, effectively lowering interest rates.

Real Estate Loan Checklist

|

Requirements |

Step 1 |

Step 2 |

|

Purpose of Loan:

|

|

|

|

Additional Requirements for:

|

|

|

Frequently Asked Questions

- What are some of the loan-related fees that are for the account of the borrower/member?

- Processing Fee (P3,500.00, to be deducted from loan proceeds)

- Appraisal Fee (P3,000.00 – estimate within Metro Manila, to be deducted from loan proceeds)

- Notarial fees (depends on Notary Public)

- Documentary Stamp Tax (pay to BIR, 1.5% of purchase price)

- Transfer Tax (pay to LGU, for transfer of title to member/borrower, 75% of 1% of purchase price)

- Registration fees (varies, pay to Registry of Deeds)

- MRI (varies based on loan amount, age of borrower/member, etc.)

- Fire Insurance (varies based on appraised value)

- For Construction/Renovation (varies based on location and construction cost)

- Complete Building Plans

- Building Permit

- Construction All-Risk Insurance (CARI)

- Can I apply for a Real Estate Loan to construct a house if the land title is still in the name of my parents?

- Yes you can but your parents will have to become Associate Members of the coop and sign as co-borrowers. Also, being the registered owners of the property, they will have to sign the mortgage documents.

- Why is our interest rates seem higher than banks?

- Considering that we are a cooperative, we are required to give Patronage Refund annually to members who patronize our loan products. Thus, our interest rates effectively become lower than our published rates. Also, our interest rates are fixed for the duration of the loan.

- How are loan proceeds released?

- For purchase of property, the loan proceeds will be released to the owner/developer.

- For construction/renovation, the funds will be released to the contractor on staggered basis based on completion. You will be paying interest only based on the amount already released. Your monthly amortization for both principal and interest will start only when loan has been fully released.

- I want to construct a house but I don’t know any Architect and/or Contractor. Can the coop help?

- Yes, the coop can help you to build your dream house. For now, we only accommodate construction/renovation using our own design and build team. Later, we may accredit other contractors.

- How will I pay for my monthly amortizations?

- Monthly amortizations can either be via payroll deduction (e.g. Auto-Debit Arrangement) or post-dated checks. Please make sure your account is sufficiently funded on your monthly due dates to avoid penalties.

APPLY NOW! (Or go to Member's Area - Real Estate Loan. Login required.)